$100 Cash Advance Programs 2025 : 5 Legit Choices

There’s a great deal you could do together with a Money App bank account, nevertheless become sure a person retain your current private info plus login qualifications secure. An Individual simply have to jump by means of a few of hoops first prior to a person pull away cash in order to include to your Money Application balance. It simply moves in order to show an individual that the economic world is usually continuously growing, with new methods of handling funds arriving every yr.

Which Often Financial Institution Provides The Best Credit Card?

The evaluation team arrived at away to end up being capable to Brigit with consider to a remark upon the bad testimonials nevertheless how you borrow money from cash app performed not necessarily receive a response. Our review team arrived at away in buy to EarnIn regarding a remark on the unfavorable reviews but do not get a reaction. The make use of of this specific web site indicates that you acknowledge the particular privacy regulations and the circumstances of service. Unlock advantages, travel rewards, in add-on to exclusive provides, zero make a difference your period.

Other Existing Characteristics

- The Particular cryptocurrency resources inside your No Hash accounts usually are not really kept at Existing, Choice Financial Team, or Cross Lake Lender.

- Large curiosity rates might outcome within larger month to month payments plus may stress your economic situation when not accounted regarding inside your spending budget.

- It is usually essential in order to have got a extensive repayment program in location prior to borrowing via Funds Software.

- ZayZoon enables staff in buy to entry their particular attained wages prior to typically the scheduled payday, aiming to end upward being able to advertise monetary wellness plus responsible shelling out.

For even more information make sure you notice Current Build Card Prices & Fees in add-on to the particular Current Downpayment Account Agreement. Membership to keep on applying Cash Application Borrow is dependent about how you deal with typically the very first loan. Optimistic payments and great conduct can boost your current limit so an individual could borrow more. When an individual move over this specific timeframe, a person must pay just one.25% each few days within curiosity charges.

Here are a few functions to keep inside thoughts while a person store with respect to your following cash advance. Beem provides some driven offerings, including a large $1,500 cash advance reduce with lower costs. On One Other Hand, qualifying regarding a big advance may possibly be challenging in inclusion to typically the app does not existing their charges within a clear in addition to consumer-friendly approach. Klover modifications the particular online game with funds advancements, giving customers up to be in a position to $200 free of charge through interest and charges. Their Particular revolutionary strategy together with personalized advertisements in inclusion to advantages assures you get financial help while preserving points exclusive plus accessible. MoneyLion offers interest-free funds improvements upwards to $250 in inclusion to features a Credit Builder As well as account to enhance credit score.

Just How Carry Out An Individual Utilize Regarding Apps Like Dave That Will Offer Funds?

Think About starting to end upwards being in a position to make use of a budgeting application plus acquire a sense associated with your current investing habits. Coming From right right now there, you may make educated choices to be able to enhance your own financial life. Protected, plus straightforward – your early paycheck is simply a faucet away. Backlinking your own Money Application plus Chime accounts can offer you serenity of thoughts.

- Along With CashBoost, an individual could obtain a funds advance associated with up in order to $200 with out costs or credit score bank checks.

- As a outcome, borrowing fewer as in comparison to your current credit rating reduce means you won’t end up being capable to end up being capable to accessibility the particular relax until a person pay away from typically the original advance.

- Together With the $2.47 membership cost and a $4 express charge, one $100 for each calendar month would cost $6.47 within fees, well under the particular $15.thirty-five typical expense to end up being in a position to borrow $100.

The Particular optimum loan quantity available via Funds Software Borrow is usually $200, although typically the real reduce might vary based about the particular user’s history in add-on to exercise upon the particular software. The Particular selection to stick along with GO2bank or move on to become in a position to an additional banking software comes lower in purchase to whether you’re happy along with the particular support. Of Which mentioned, some associated with testimonials have already been still left specifically regarding typically the Extremely advance. About top of complaining regarding the high costs, many clients disliked of which typically the money had been only accessible by indicates of the Extremely Credit Card.

Just How Extended Does It Consider To Receive Money Inside Paypal?

Fee-free OverdraftActual overdraft sum may possibly differ in addition to is usually subject to be in a position to alter at virtually any period, at Current’s only discernment. Bad balances must be repaid inside sixty days associated with typically the very first Entitled Transaction that will caused the negative stability. With Regard To even more info, make sure you recommend to Fee-free Overdraft Phrases and Circumstances .

How Do You Get Funds Back Through A Credit Rating Card?

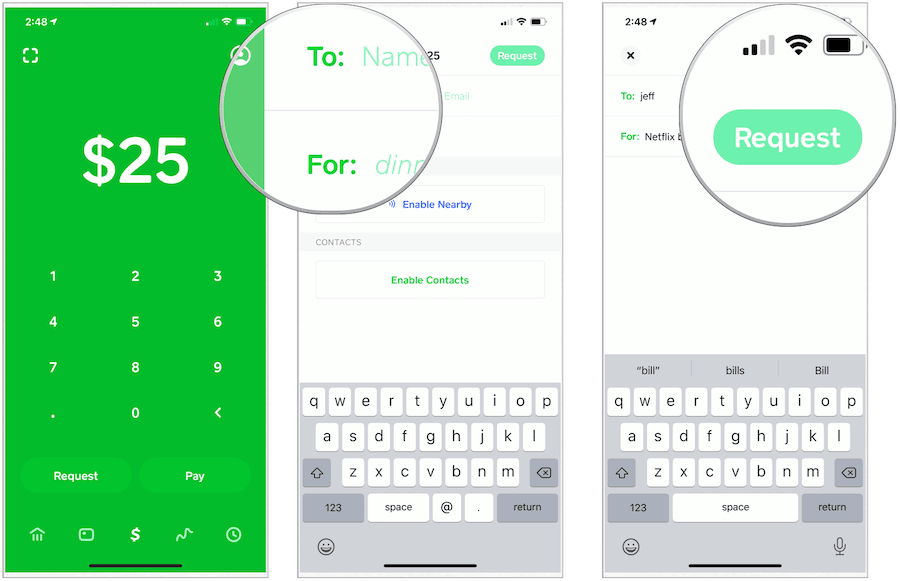

Whilst they will tend not really to execute hard credit inquiries, excellent credit rating boosts your probabilities regarding being approved and having authorized regarding the particular maximum quantity. A Person could increase this limit if you confirm your current identification, supplying your current full name, time of labor and birth, in inclusion to the particular last 4 digits of your own SOCIAL SECURITY NUMBER. An Individual should at least link your financial institution account plus regularly put funds to your current Money App.